Introduction to investing

Investing can be an effective way to put your money to work and potentially build wealth. When I first started earning a salary I thought to myself 'what should I do with this money now' which then brought me across the idea of investing with the aim of generating more money. I also often wondered how were people able to afford supercars and mansions when I was only making enough to pay for basic living necessities.

How do people invest?

If your like me and your curiosity often wonders how wealthy people invest their money and what should I do with my income you've come to the right place as this blog will save you time researching the interenet.From what Iv'e discovered there are numerous ways to invest with three over arching investments which inlcude property investments, investing in financial assets and investing in personal businesses which has been discussed below.

Purchase Assets over Liabilities

Purchasing assets compared with liabilites is the number one most important concepts of gaining financial freedom. A common saying goes"an asset puts money in your pocket, while on the other hand, a liability is something that drains money from your pockets. An example of assets could include rental properties and dividend paying stocks. And an example of a liabilities could include expensive material possesions and depreciating cars.

Why do people invest and why should you invest?

Investing in income producing assets that consistently generate recurring cashflow, over time will eventually allow you to live the life you desire without the constant pressure of worrying about money. After accumilating a protfolio of cashflowing assets you will have the ability to have more opportunities that life offers and the freedom to choose what you want to do with your time.

In New Zealand, the media in the financial sector are constantly stating that Kiwis have poor financial literacy which has begun to slowly influence society to believe that this is true. It is important you don't let other people's negative opinions influence your behaviour with investing as it is likely these people are insecure about their own limiting beliefs about life, so therefore try to aim to develop the skill to recognize and ignore these comments.

When should you invest

People always question when is the best time to invest and will wait years to invest when really they are procrastinating and the best time to start investing is right now. Everyone can be an investor and if you believe you cant thats just a tyranny of soft expectations that you have heard constantly. By developing a growth mindset and puting the work into educating yourself about personal finance you can build the life you want.

Barefoot investor 60/40 rule

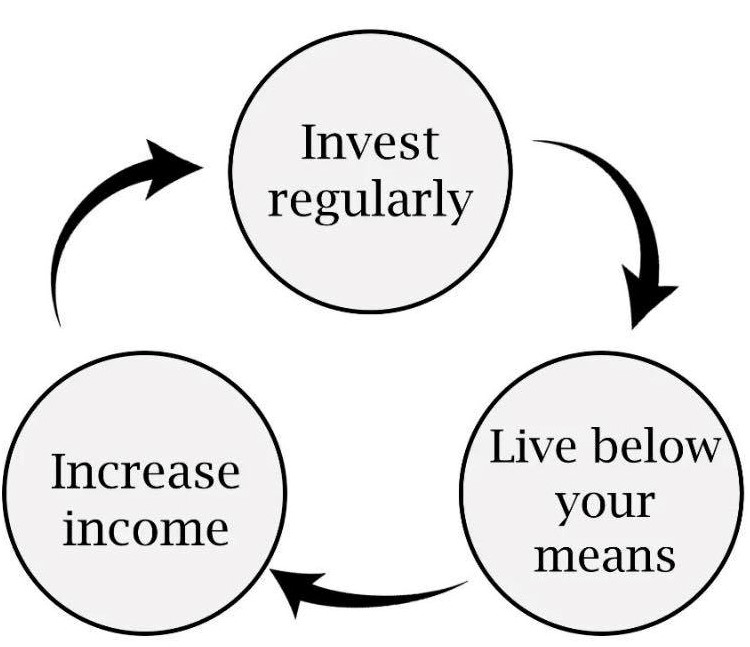

In a popular personal finance book the Barefoot investor, Scott Pape suggests spending 60% of your income on necessities, and putting the other 40% going towards paying off high-interest debt, saving and building your wealth. Ultimately this is a rough guide and the four main pillars to creating wealth is by creating beneficial financial habits, lowering your expenses, and increasing your income which will allow you to have more to invest in assets!

Identify bad spending habits

It is important to be self aware to recognise where you could be potientially saving money and investing. Taking accountability and deciding to change bad financial habits will enable you to have more money to invest.

Make a budget

When trying to build the life you want it is important to create goals and put an action plan in place to follow. Creating a budget and sticking to it will allow you to recognise where your weekly spending is going and will enable you to identify where money could be saved to later invest. In order to create a budget you could utilise software such as microsoft excel or use a physical planner if your perfer old methods.

Another great way to help you create a budget is by using a income calculator which will help you determine your earned income after tax PAYE Calculator.

Stop consuming & start creating

In today's world social media is constantly competing for your attention by repeteadly placing addictive content on your phone screens in order to increase engagement to sell advertising.

Building a personal business or creating a side hustle will allow you to increase your income and provide you with additional monthly income which will allow you o have more financial stability. Some examples of side hustles could include:

- Providing a service

- Selling a product

- Renting out a spare room

- Selling old stuff on facebook marketplace

- Uber driving and delivery services

- Freelancing or casual work

- Tutoring

- Offering to teach skills